- Last-Mile

Trends that Will Impact the Last Mile in 2024

Setting the Scene

Before we begin to look ahead to 2024, let’s examine the prevailing state of supply chains over the past few years.

As published on the CLDA FALL Magazine 2023, the pandemic wrought havoc on supply chains as consumers confined at home spent more of their discretionary income on goods rather than services. As a result, e-commerce experienced an unprecedented surge, placing additional stress on supply chains that struggled to adapt to this abrupt change in consumer behavior. Bottlenecks at major ports led to extended delays in the transit of goods, testing the patience and loyalty of both consumers and businesses alike, as lengthy delivery windows became the norm.

As the world emerged from the epidemic, supply chains grappled with a post-pandemic hangover. Companies focused on creating more resilient supply chains and emphasized fixing the weaknesses exposed by the crisis. Cost reduction became a key priority, as businesses sought to mitigate the inflationary pressures that resulted from the pandemic's economic fallout. To achieve these goals, companies accelerated their investments in technology with a focus on automation, digitization and predictive analytics. These measures aimed to build stronger, more agile, and efficient supply chains capable of withstanding future challenges, safeguarding the global flow of goods and keeping bottom lines intact.

The last mile - the costliest and most complicated leg of the supply chain - will continue to be a focus for logistics professionals as we move into 2024. External macroeconomic trends will shape the technologies and processes last-mile logistics specialists employ as they seek more efficient, resilient and customer-centric supply chains.

And if 2023 has been any indication, failure to adapt and accommodate these trends may result in further bankruptcies and ceased operations within the logistics industry.

Macroeconomic Trends of 2024

Next year, the last mile of the supply chain is poised for a significant transformation, influenced by several pivotal trends that will have a profound impact on shipping and logistics. These trends encompass inflationary pressures, labor-related challenges, shifting consumer preferences and an increasing focus on sustainability.

Inflation, High Interest Rates & Fuel Price Volatility:

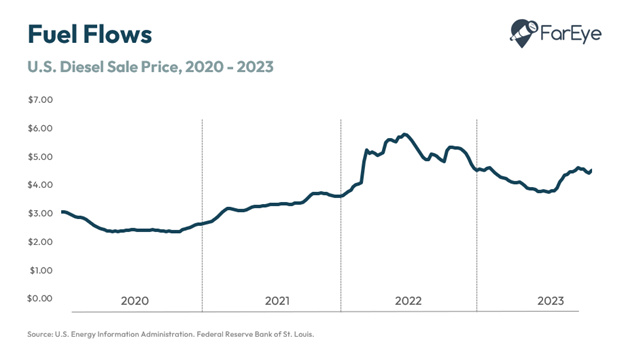

Arguably the most significant macro trend shaping last-mile delivery is the risk of inflation and subsequent escalation of operational costs. Compounding costs further are high interest rates which have raised the cost of capital considerably. Given that fuel is the lifeblood of delivery operations, recent fluctuations in fuel prices have strained last-mile delivery providers, necessitating a realignment of strategies to ensure continued profitability. Already, S&P Global predicts that fuel prices will increase through 2024 as demand outstrips supply.

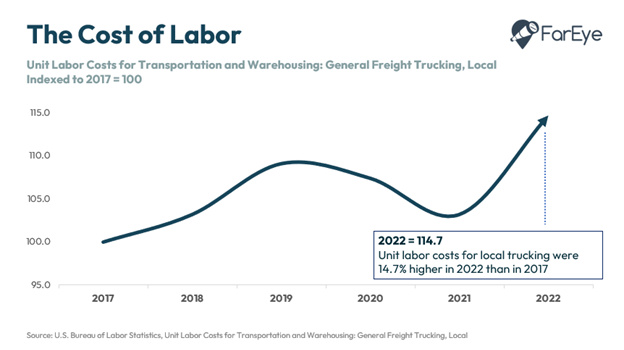

Labor Costs and Challenges

Labor costs, a perennial concern for logistics companies, are expected to continue to increase into 2024. The backdrop of potential strikes and worker shortages looms large, exemplified by the case of Yellow, a prominent trucking company that faced bankruptcy partly due to labor-related challenges. Similar issues could disrupt the seamless flow of last-mile delivery services, causing delivery delays and operational inefficiencies. Tackling these obstacles will require innovative solutions, such as investments in technology and automation to reduce dependence on human labor, boost efficiency and minimize the impact of disruptions.

Reduced Consumer Demand and Shipping Rates

Consumer demand for online goods is anticipated to remain somewhat muted due to reduced disposable income, greater spend on services and economic uncertainties. This subdued demand has caused an observable downturn in freight demand, as freight volumes in the U.S. fell to their lowest levels in nine years in the fourth quarter last year. This is putting downward pressure on shipping rates and creating a challenging environment for carriers whose revenues are being suppressed while their operational costs are on the rise, thus squeezing margins and hurting profitability.

Long-Term Contracts in an Inflationary Environment

A considerable challenge pertains to the issue of long-term contracts that do not have inflation-adjusted clauses and therefore may no longer accurately reflect the current economic landscape. Many carriers have entered into these extended agreements with shippers at rates that may no longer align with the operational costs of today’s inflationary environment. This discrepancy has the potential to further squeeze the profitability of last-mile delivery carriers, requiring either contract renegotiations or increased efficiencies to absorb increased operational costs.

Sustainability Costs and Responsibility

The focus on sustainability will only grow stronger in 2024, and will continue to shape last-mile delivery operations. Consumers, shippers and regulators are increasingly emphasizing environmentally friendly shipping practices, putting pressure on carriers to offer them. However, transitioning to sustainable logistics comes at a cost, leading to a critical question: who will bear the financial burden for more sustainable shipping? Striking the right balance between sustainability and cost-effectiveness is a difficult task. Last-mile carriers will need to navigate these competing demands skillfully and explore innovative, cost-effective and sustainable logistics solutions.

The Consumer and the Shipper

In the intricate web of last-mile delivery, the relationship between consumers, shippers and carriers is dynamic and interdependent. Consumers look to shippers for efficient, reliable delivery services, while shippers rely on carriers to fulfill these expectations. Carriers, in turn, aim to meet both consumer and shipper demands, ensuring that packages reach their destinations according to shipper delivery windows at the lowest cost possible.

However, as consumer preferences evolve, there is a discernible shift toward enhanced delivery experiences. Consumers’ once paramount emphasis on rapid delivery is giving way to a more balanced perspective that now also prioritizes cost-effectiveness and eco-friendly practices. Shippers therefore need to adapt to these changing demands by seeking ways to optimize the last-mile delivery process and meet consumer expectations without compromising sustainability and affordability. Oftentimes, they rely on their carrier partners to help make this happen.

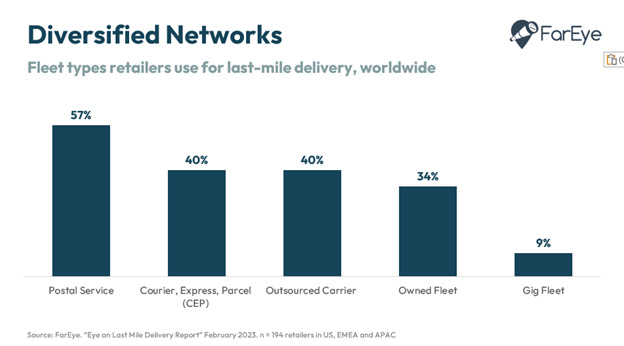

To strike this balance between cost-efficiency, sustainability and exceptional delivery experiences, shippers are beginning to diversify their carrier partners. They are engaging in rate shopping between carriers to secure cost-effective options while diversifying their delivery networks among numerous carriers, including smaller regional ones, to increase flexibility and operational efficiency. This will require shippers to invest in technologies such as multi carrier parcel management solutions to automate carrier allocations and boost network efficiency. In a recent study conducted by FarEye, 59% of retailers expect their delivery networks to become more diversified in the next 5 years.

Carriers take note.

Logistics Carriers: Strategic Trends of 2024

With a cautious outlook for 2024, logistics carriers are proactively addressing macroeconomic challenges by embracing technology-driven strategies. They are leveraging embedded big data management, analytics, advanced modeling and automation to pave the way for innovative solutions, strengthening their resilience and enhancing resource optimization.

Profitability growth is a function of increasing revenues and reducing costs. In a logistics environment where revenues are being squeezed and costs are being inflated, profitability hinges on enhanced services and efficient operations.

Here are a few strategies progressive carriers are likely to adopt to enhance services and boost logistics efficiency in 2024:

Diversified Service Offerings

In response to shifting consumer demands and expectations, logistics carriers are actively diversifying their service offerings. This includes providing a broader spectrum of delivery options, such as same-day, next-day and sustainable delivery, as well as more flexible and narrower delivery windows. Consumers today appreciate a range of choices when it comes to their online delivery options, and carriers are pressured by shippers to meet these expectations.

Pick-Up/Drop-Off (PUDO) Services

The rise of pick-up and drop-off (PUDO) services is transforming last-mile logistics. Carriers are actively expanding their networks of PUDO locations, enabling customers to conveniently pick up their parcels or drop off returns at points strategically located as close as possible to them. This model not only saves time for customers but also contributes to reducing the environmental impact of last-mile delivery. Using these delivery points, carriers can reduce the size of their delivery networks and in turn offer faster, cheaper and more secure deliveries while reducing the number of miles driven. As such, PUDOs are gaining popularity. DHL has already pioneered a robust PUDO network in Europe, with over 80,000 service points and more than 20,000 parcel lockers within the continent.

Green Fleets

Many logistics carriers are taking steps to address the growing concern of increased carbon emissions, driven in part by retailers' need to hit environmental, social and corporate governance (ESG) and emission-reduction targets. Some carriers are launching or acquiring green fleets - such as bike, electric or hybrid vehicles - as a part of their commitment to reducing carbon emissions. This trend is exemplified by cases like Nationex's acquisition of CurrentPlus in Canada.

Several new delivery start-ups are racing to serve the growing market. Companies like Sweden’s Urb-it, Germany's Liefergrun, the UK's Zedify and Packfleet, and New York-based DutchX are all tapping into retailers' “green delivery” needs. Collectively, zero-emission delivery startups have raised around $1Bn so far.

Electric vehicles (EVs), however, bring about a new set of variables for dispatchers to consider.

EV routes must account for battery life and range, charging station location and availability, charging time, air temperatures and elevation gradients. The routing software carriers use today must therefore be able to accommodate these new constraints.

Technology Investment

Logistics carriers are making substantial investments in upgrading their technological capabilities, introducing advanced solutions to streamline and enhance the entire shipping journey from order placement to delivery. With different service levels and delivery methods on offer, carriers are adapting to meet a variety of customer preferences. Carriers are also investing in real-time visibility tools that track shipments from order to delivery, tools that help enhance the customer delivery experience efficiently and at low cost.

Big Data Management, Advanced Analytics & Modeling:

Big data management and analytics are emerging as essential tools in the last-mile logistics sector. Carriers are harnessing the power of data and the actionable insights that they provide to optimize various aspects of their processes and services. Advanced analytics and modeling (often broadly referred to as AI/ML), driven by big data, are becoming integral to operations, enhancing everything from route planning and delivery scheduling to sustainability tracking and transportation visibility. Carriers are leveraging data-driven insights to make informed decisions, accelerate and automate processes to drive efficiency, and improve the quality of their services.

The increasing appetite for advanced analytics is a significant part of this technological transformation. According to a Gartner survey, advanced analytics ranked among the top 2 emerging technology investments for supply chains, with only 9% of supply chain organizations reporting no plans to invest.

Advanced analytics plays a crucial role in helping logistics carriers optimize various aspects of last-mile delivery, such as vehicle routing and scheduling, where analytics makes use of historical data, real-time traffic updates, and delivery constraints to devise efficient routes. This not only reduces human interaction, travel time and fuel consumption but also ensures the most effective utilization of delivery vehicles.

Additionally, analytics helps carriers track and reduce their carbon emissions. By scrutinizing environmental factors like distance traveled for each delivery, fuel consumption and vehicle emissions, carriers can spot areas for improvement and incorporate greener practices into their last-mile deliveries.

One critical area where analytics shines is in providing transportation visibility and predictive estimated day of delivery and time of arrival (EDD/ETA). Analytics can leverage historical data, current traffic patterns, driver speed and even weather conditions to offer more precise and updated EDD/ETAs to customers. Further, analytics can help carriers implement dynamic appointment scheduling, which responds to real-time data and customer preferences. This dynamic approach allows carriers to adapt delivery windows and appointments as needed, providing flexibility for both customers and carriers while ensuring resources are used most efficiently.

Optimizing freight capacity utilization is another aspect that benefits from advanced analytics. By considering shipment volumes, vehicle capabilities and other constraints related to the delivery route, advanced analytics can help better plan vehicle needs and optimize freight capacities across various fleets. This ensures that vehicles are loaded to their most efficient capacities for a given route without breaching weight limits or affecting delivery schedules.

Tying it All Together

So there you have it. Who said logistics was easy and boring? Rising costs and economic uncertainty will continue into 2024. E-commerce demand and shipping revenues may falter. As shippers look to reduce costs, streamline their supply chains and enhance customer delivery experiences, last-mile carriers will need to embrace further flexibility, innovation and efficiency to survive and thrive.

In an industry that has already seen established logistics carriers wiped off the map this year, staying the course in 2024 may no longer work. The most progressive, informed and agile organizations will prevail.

Stéphane Gagné is VP of Products at FarEye where he is part of the team responsible for driving product vision and development. He works hand-in-hand with customers solving their logistics challenges and helping them stay at the forefront of delivering a superior delivery experience with FarEye’s last mile logistics solutions.

Stephane has been in the transportation & logistics and technology industries for over 20 years. He also holds a MBA from the London Business School, as well as a Bachelor of Science degree in Engineering from the University of Ottawa.

Let's Talk to Our Experts and Optimize Your Deliveries Today!

An expert from our team will reach out within 24 hours